*The form data is not saved as an unalterable. (You don't need to know programming, but comfortable in how data moves and functions in databases). Yes, Breeze is truly THIS good at what they do.Ĭons: *Someone needs to know a little about database structures to set-it up.

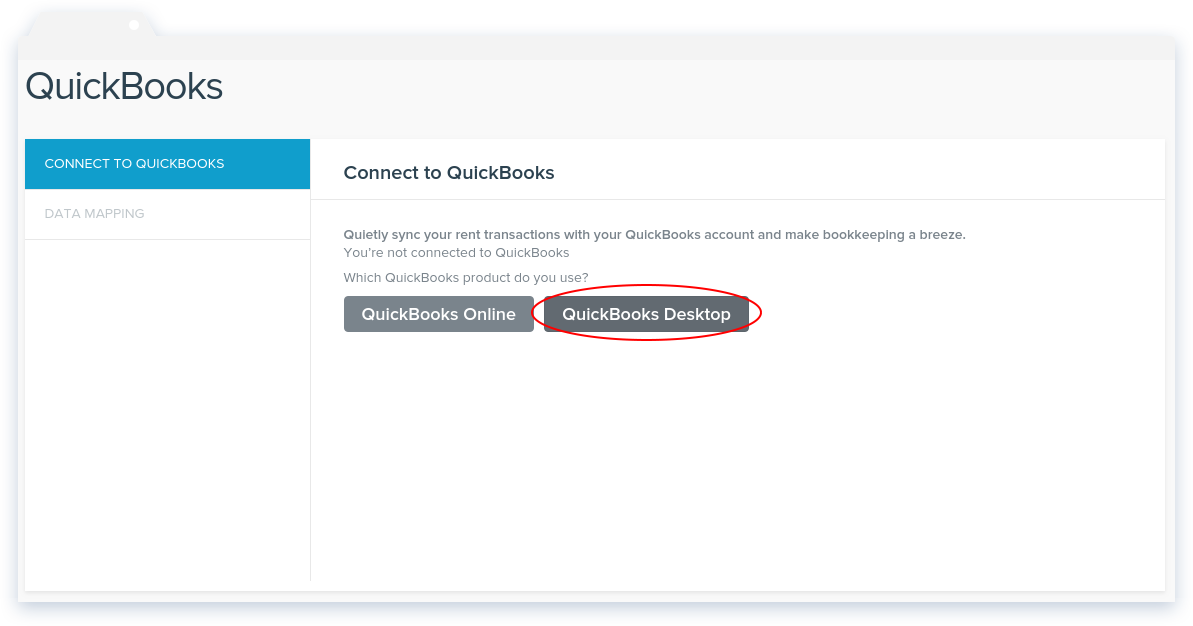

SYNC BREEZE GIVING WITH QUICKBOOKS FREE

Breeze broke us free from serving technology and flipped things around so that the technology now serves us.

SYNC BREEZE GIVING WITH QUICKBOOKS HOW TO

With Breeze, the learning curve was not so much learning how to use it, but how to use it more with new procedures and directions that we have never tried before.

But with Breeze, we simply looked at it and pretty just much started using it. I watched several training videos from Planning Center during our evaluation and still found myself struggling to adopt their technology into our processes. Planning Center does offer many similar services to Breeze, but it is not as simple or intuitive. But, in my opinion, worship planning is a niche for Planning Center. Our worship ministry has used Planning Center for years and it is great for worship planning and communicating with the worship teams.

Our most difficult transition was with our child check-in system which is one area where Breeze excels. Reasons for Choosing Breeze: We chose Breeze CHMS over Planning Center because it seemed simpler and more intuitive. It's worthwhile option, especially for those who are working in a budget and still want to have a nice, full, robust system. It's actually a really good place to start and I highly recommend that you take a look at Breeze. If I was going to suggest to you to use Breeze, I think that I would take a really good look through their tutorial, through their online system, chat with the representatives. It was so easy to keep going and keep using after the initial onboarding section. There's a lot of administrative stuff at the start, but once we got through that, we were for, lack of a better term, riding a breeze. It was everything that we needed in one space at one cost.īreeze was relatively easy to get started. We could basically do everything that we need to do. We could create children's ministry stuff. And really at the end, Breeze was just the best choice.īreeze was the best choice for us in the end because it really gave us everything we need, forms. When we were looking around at different softwares to use, we'd looked at Planning Center, Tithe.ly, and a whole bunch of different options. And if you want more reviews, click right down below. I would give Breeze a four out of five stars. You may receive a discount on your purchase through the link, and we may receive a commission.Jon K.: Hi, my name is Jon. If you have questions or run into any hiccups when connecting your HoneyBook to QuickBooks Online, please feel free to contact us and we’ll walk you through your specific situation!Īffiliate links noted by * are contained in this post. If you see any grey QB icons, that’s an indication that it didn’t automatically sync, and you’ll want to click on the icon to “send” it over to QBO. In HoneyBook, under the Payments section, you’ll start to see green QB icons next to the payments to let you know that they have synced with QBO. If you record a cash or check payment in HoneyBook, that will also transfer into QBO as well! Since there is no payment processing fee, it’s a lot easier to match those payments up in your Banking screen. Once a client makes an electronic payment in HoneyBook, HoneyBook will send instructions to QBO to enter the payment processing fee for the transaction and will match that payment up to the correct Bank Deposit in QBO! When this second option is selected properly, you’ll have a seamless integration between HoneyBook and QuickBooks Online! The second option is one you don’t want to miss, though!įor the second option, you’ll want to choose the bank account where the payments are eventually deposited into (usually your Business Checking account). When you look at the options in the drop-down list, they don’t fully align with how sales tax should be calculated on invoices. This should be the same sales tax rate in HoneyBook for the invoice. QBO should be calculating sales taxes on invoices based on the location set up in QBO. For the first option, you’ll likely want to leave this one as N/A, even if you charge Sales Tax to your clients.

0 kommentar(er)

0 kommentar(er)